Compliance issues with the changes in the internal and external environment of enterprises, in business operations gradually rose to the same height as business management, financial management, the focus of attention. However, how to effectively carry out corporate compliance work and prevent all legal risks from happening in the first place is troubling many enterprise managers.

On September 14th, WeLegal and King&Capital Law Firm jointly held an offline salon, targeting at the widely concerned issues of "Criminal Compliance - Anti-commercial Bribery Compliance Management", "Investment Compliance - How to Grasp the Dividends of Investment Compliance from the Commercial Dispute Resolution" and "Financial and Tax Compliance". and "Tax Compliance - Tax Risk Management of Corporate Contracts", three partners from King&Capital Law Firm shared their views.

In this article, we will review the highlights of this offline salon, hoping to provide you with some new inspiration and gains if you are also concerned about the above corporate compliance issues.

I. Anti-Commercial Bribery Compliance Management

The topic shared by Mr. Xu Ying, Senior Partner of King&Capital Law Firm and Deputy Director of Kyoto Criminal Defense Research Center, was anti-commercial bribery compliance management.

As the first guest speaker, Mr. Xu Ying firstly centered on several basic issues of criminal compliance, and clarified several key concepts in criminal compliance from the general framework:

Compliance, Criminal Compliance, Compliance for Companies Involved in Cases

Difference between compliance and company legal affairs, permanent legal counselor

The difference and integration of criminal compliance and enterprise risk prevention and control system

Criminal Compliance Refinement - Criminal Specialized Compliance and Criminal Comprehensive Compliance

And through some data and typical cases to illustrate the criminal compliance work can bring long-term dividends and timely dividends to enterprises. Long-term dividends are mainly reflected in the fact that compliance management can reduce the risk of enterprises suspected of committing criminal offenses, and become an effective reason for enterprises or their management personnel to get out of the crime when they are involved in criminal legal offenses. Timely dividends are reflected in the leniency in sentencing brought to the enterprises and individuals involved by the compliance rectification of the enterprises involved in the case. Therefore, from the cost and benefit point of view, enterprise criminal compliance management will be a cost-effective management initiative, effectively improve the soft power of the enterprise, reduce the legal risk of enterprises involved in criminal offenses, and help enterprises to walk steadily and create value for the enterprise.

The effectiveness of the compliance system, is an important goal of compliance governance, effectiveness compliance does not mean zero occurrence of violations, the U.S. Department of Justice, June 2020 version of the "Corporate Compliance Program Evaluation" of the effectiveness of compliance in the expression: "will devote appropriate attention and resources to high-risk transactions, even if the system fails to prevent a violation, the prosecutor can also believe that the quality and effectiveness of the compliance system and consider it as a mitigating factor." Enterprises should avoid falling into misunderstandings when establishing a compliance system and evaluating its effectiveness.

At the same time, Ms. Xu Ying combed through the relevant crimes of commercial bribery in China in detail and analyzed in detail the current situation of judicial practice of enterprise-related crimes and the current situation of enterprise management from the latest rules, such as the setup of the enterprise compliance organization, the "Anti-commercial Bribery Employee Handbook" and education and training, the policy on gifts and hospitality, the system of declaration of acceptance of gifts, the rules on conflict of interest, the complaint and reporting system, and the anti-bribery investigative body, The willingness and actual situation of the enterprise to actively investigate and deal with bribery by internal employees.

Investment Risk Management for Corporate Compliance - How to Grasp Investment Compliance Dividends from Commercial Dispute Resolution

Mr. Ma Tao, a partner of King&Capital Law Firm, has been practicing as a lawyer for fifteen years and has in-depth theoretical research and rich practical experience in investment and financing, transaction structuring, project negotiation, risk control, and difficult commercial dispute resolution.

In this salon, Mr. Ma Tao shared his views on the development trend of compliance and compliance management, the summary of typical types of investment disputes, and the key points of investment compliance operation and the outlook of changes.

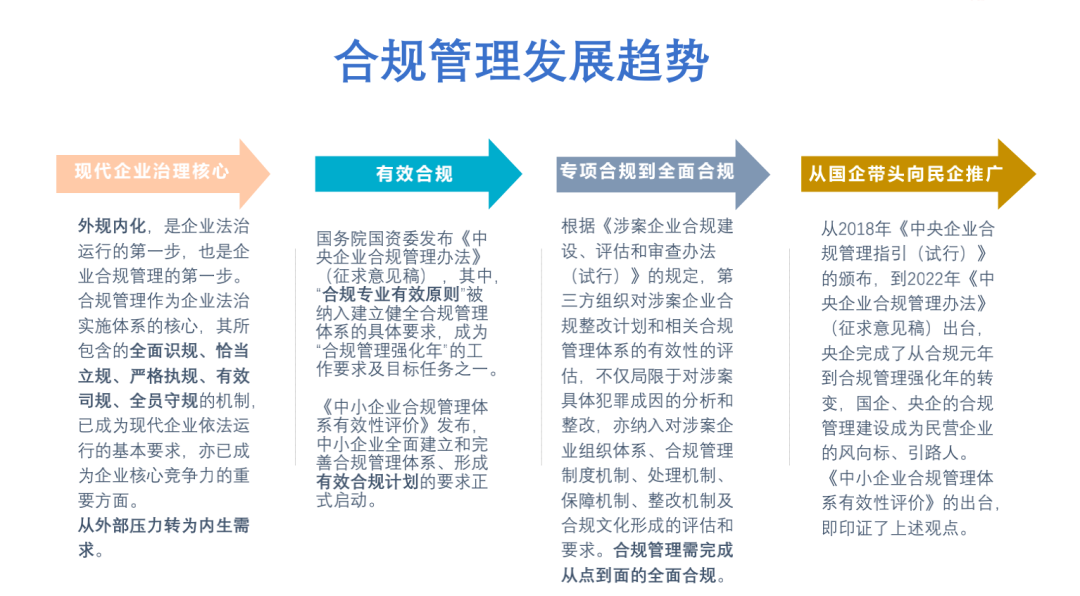

Mr. Ma Tao believes that from the perspective of the development trend of corporate compliance management, compliance management has advanced from "state-owned enterprises to private enterprises" and become "the core of modern corporate governance", and is moving from "special compliance to comprehensive compliance" and "effective compliance". It is moving towards the goal of "effective compliance" from "special compliance to comprehensive compliance".

Then Mr. Ma Tao started from typical disputes such as shareholders' capital contribution disputes, shareholders' qualification confirmation disputes, betting agreements (confirmation of contract validity disputes, equity transfer disputes, capital increase disputes), disputes on the mixing of corporate personalities, and common disputes on post-investment management, and put forward the ways and methods of identifying the compliance risks and sorting out the list of compliance obligations in the light of three dimensions of specific matters, manifestations and inherent risks, and combined them with specific case studies to explain why. With specific cases, it explains why the value of compliance can be better emphasized from the perspective of commercial dispute resolution, and why the dividends of compliance can be more effectively grasped.

Finally, in response to the issue of investment compliance operation points and changes in outlook, Mr. Ma proposed to prevent "paper compliance" and "false rectification", and only by "making clear the rules with cases", precise and accurate implementation, can compliance management be improved. The only way to improve the effectiveness of compliance management and get the dividends of compliance is to realize "case by case" and precise implementation.

Tax Risk Management of Enterprise Contracts - Key Points and Methods of Reviewing Tax-Related Clauses

Mr. Teng Jie, a partner of King&Capital Law Firm, has provided professional legal services for many financial institutions, covering the development of comprehensive family trust programs, financial product design, corporate contracts and tax review, corporate tax planning, etc. In this session, Mr. Teng Jie will share with the audience the key points and methods of reviewing tax-related clauses in corporate contracts.

Mr. Teng Jie explained the three perspectives of combing contractual tax risks, the basic principles and methods of contractual tax risk prevention, and how to strengthen the tax risk management of the whole staff in this sharing.

Mr. Teng Jie firstly introduced five common tax risks in contract through a case of "Misunderstanding of Contract Price", which are the risk of tax obligation, the risk of tax time, the risk of tax invoice, the risk of tax cost and the risk of related transaction.

In the second part, Mr. Teng Jie explained the main objectives of tax risk management and the principle requirements of tax planning for contracts by the tax authorities with reference to different cases. He also analyzed a series of tax-related clauses in common contracts, such as contractual form clauses, contractual subject matter clauses, price or remuneration, payment clauses, invoicing clauses, liquidated damages clauses, tax underwriting clauses, and place of performance, one by one, and introduced the contents, significance The content, significance and precautions of the corresponding clauses were introduced.

Finally, Mr. Teng Jie shared the ideas and methods to strengthen the tax risk management of the whole enterprise, and put forward the three-class systematic combing method of tax risk, which includes: macro-class: top-level structure - legal and tax analysis of equity structure; meso-class: contract risk - legal and tax analysis of contract mode selection and terms; and contract risk - legal and tax analysis of contract mode selection and terms. -The middle class: contract risk - legal and tax analysis of contract mode selection and terms; micro class: financial processing - how to correctly deal with legal and tax issues in the process of daily accounting.

At the end of the event, Mr. Chu Changzhi, Managing Partner and CEO of King&Capital Law Firm, expressed his gratitude to the executives and legal officers of the enterprises for coming. He talked about the complex and changing economic situation, enterprises need to be well prepared to avoid risks and effectively prevent. He hoped that the sharing of the lawyers could inspire the building of compliance management system for enterprises and effectively empower their compliance operation, so as to gradually realize a benign business environment of mutual benefit and win-win situation for steady development.

Today, as the topic of corporate compliance is getting more and more attention, King&Capital Law Firm will continue to pay attention to the development of the industry, gain insight into the latest needs of enterprises, and provide cutting-edge legal analysis, and the King&Capital team of lawyers will, with excellent professional ability and responsible working attitude, help enterprises focus on complying with the business, and escort the healthy development of the enterprises.

Translated with DeepL.com (free version)