Recently, Beijing king&Capital law firm YeJing, CaiKangMiao lawyers successfully represent a will inheritance dispute case. In the case, the decedent wrote a self-written will in his last moments of life, after a hundred years left behind the house belongs to the plaintiff, the two lawyers as the defendant's attorney, through the access to the house files and other ways to learn that the decedent purchased the house used his deceased spouse's service, and the decedent's spouse did not enter into a will before his death, so that the value of the property value of the work of the offsetting should be According to the legal inheritance to be distributed. The two lawyers fought for the client's maximum rights and interests through their rigorous and conscientious work.

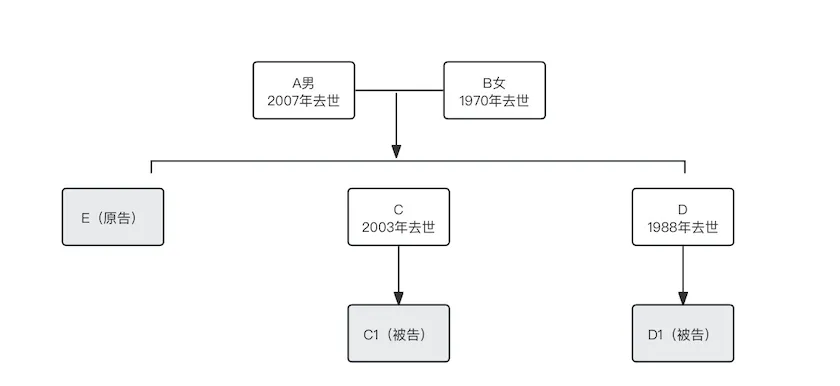

In this case, the decedent A (male, died in 2007) and B (female, died in 1970) are husband and wife, and they have three sons, namely, the eldest son C (died in 2003, and has only son C1), the second son D (died in 1988, and has only son D1), and the third son E. Before his death, A has made a self-written will, and explicitly designated a set of houses located in Haidian District of Beijing to be inherited by E. After A's death, A has made a will, and explicitly appointed a set of houses located in Haidian District of Beijing under his name. After A's death, E sued C1 and D1 for inheritance of the house.

Two lawyers from King&Capital, as the litigation agents of Defendants C1 and D1, found out that A used B's seniority discount when he purchased the house in question by accessing the file of the house in the Real Estate Center under the unfavorable circumstance that the self-written will was found to be valid. According to Article 6 of the “Answers of the Beijing Municipal Higher People's Court to Some Difficult Questions on the Trial of Inheritance Disputes”, if a deceased spouse receives policy benefits by commuting his or her length of service in accordance with the relevant national policies when purchasing a public housing unit at the cost price or the standard price, the personal portion of the value of the property corresponding to the policy benefits shall be inherited as the deceased spouse's inheritance. Accordingly, the two lawyers claimed to the court of first instance that the house in question included the use of B's length of service and the policy benefits, the corresponding property value should be B's inheritance, in the case of B's intestacy, it should be inherited by B's first heir by law, the court of first instance finally adopted the two lawyers of this defense.

After the judgment of the first instance, although the court supported the client to obtain part of the property rights and interests under the house in question, the two lawyers found that the court of first instance on the use of the house in question, B's length of service to obtain the policy benefits corresponding to the value of the property of the distribution of the inheritance of error.

The court of first instance held that the value of the property corresponding to the policy benefits of the house in question was inherited by A, E, C1 and D1, and the part inherited by A was directly attributed to E, i.e., the value of the property corresponding to the use of the house in question with the use of the work years of B was inherited by E in 1/2, and by C1 and D1 in 1/4. The two attorneys made a quick judgment after receiving the judgment of the first instance and believed that the court of first instance had made an error in this distribution, and after communicating with their clients, they immediately decided to make a decision on this distribution. After communicating with their clients, they immediately decided to appeal.

The lawyers argued in their appeal that the policy benefit of commutation of years of service did not correspond to a part of the house ownership, but rather to an amount of property value that could be clearly calculated. In his will, A only disposed of the ownership of the house in question, but did not dispose of any property other than the ownership of the house in question, i.e., he did not dispose of his own pecuniary property, and the value of the property corresponding to the length of service he inherited from B was pecuniary property, not part of the ownership of the house. Therefore, the value of the property corresponding to the use of the house in the case of B years of service should be legally inherited by E, C1 and D1, i.e., the value of the property corresponding to the use of the house in the case of B years of service should be inherited 1/3 by E, and 1/3 by each of C1 and D1, and the value of the property corresponding to the use of the house in the case of B years of service should be inherited by E, and 1/3 by each of C1 and D1. Court. With the strong arguments of the two lawyers, the second instance case started on Tuesday, and received a revised judgment from the second instance court on Thursday, which fully supported all the appeal requests of C1 and D1. Since then, the two lawyers have maximized the legal rights and interests of their clients through the first and second trials, and have won the praise of their clients.