On July 30, 2025, Ms. Nie Sufang, Senior Partner at Beijing Juyou Law Firm, was invited by New Hope Group, a Fortune 500 company, to participate in the group's second legal seminar of 2025. She delivered a specialized lecture titled “Preventing Criminal Legal Risks for Enterprises” at the group's Beijing headquarters. The training session was targeted at core personnel from the legal, financial, audit, and business departments across the entire New Hope Group, and was conducted simultaneously in both offline and online formats.

New Hope Group is one of China's earliest private enterprise groups to be established and go global, ranking 378th on the 2024 Fortune Global 500 list. It has been included in the Fortune list for four consecutive years and has been named one of the most admired Chinese companies by Fortune for three consecutive years. As a conglomerate with multiple listed companies and a broad industrial footprint, New Hope places great emphasis on compliance work and the development and cultivation of its legal team. It invites experts, scholars, and frontline legal professionals, including judicial officials and lawyers, to conduct multiple specialized legal seminars each year.

During this training session, Attorney Nie Sufang drew on her 17 years of practical experience in criminal law, particularly in handling criminal cases involving enterprises, to systematically outline the types of criminal legal risks that enterprises may face in their daily operations and the corresponding strategies for addressing them. She covered topics such as the causes of criminal legal risks for enterprises, the determination of corporate liability in criminal cases involving enterprises, responses to criminal legal risks faced by enterprises, common criminal legal risks and typical cases, the recovery and disposal of assets involved in cases, and recommendations for preventing criminal legal risks for enterprises. The lecture content was based on real-life cases, presented in an accessible manner, and not only highlighted the potential criminal legal risks across different industries and business processes but also provided direction and recommendations for corporate criminal compliance construction, receiving unanimous praise from both online and offline participants.

In the section on the overview and causes of corporate criminal legal risks, Attorney Nie Sufang systematically introduced the criminal risks that businesses may face throughout their entire lifecycle, from establishment to production and operations, and ultimately to dissolution. She also analyzed the causes of corporate criminal legal risks from both internal and external perspectives:

1. Internal causes:

Subjectively, there are utilitarian motives, a mentality of taking chances, and speculative tendencies that can easily lead companies to violate the law. Objectively, imbalances in governance structures, institutional deficiencies, or inadequate implementation can turn good people bad, such as when personal dictatorship replaces decision-making processes, which may sow the seeds of risk.

2. External causes:

Unfair market competition exists, and the widespread non-compliance in certain industries forces companies to follow suit to survive, potentially leading to liability. Some industries, due to their inherent characteristics, operate on the “fringe of legal boundaries,” such as the ambiguity between direct sales and pyramid schemes, gaming platforms being exploited for gambling activities due to inadequate management, and the petrochemical industry facing risks related to consumption tax issues, such as the potential offense of issuing fraudulent VAT invoices. Additionally, the lag in legal policies can also create risks. Emerging fields have complex legal relationships, and early practices may create hidden risks due to unclear policies.

Regarding the topic of responding to criminal legal risks faced by companies, Attorney Nie Sufang emphasized that when companies face criminal legal risks, they should adhere to the principles of “timely” and “proactive” responses to mitigate risks at the front end. In terms of specific response methods, in addition to conducting a comprehensive self-inspection, reviewing relevant facts related to the case, organizing and backing up important case materials related to sentencing, and promptly seeking professional legal assistance, Attorney Nie provided guidance on matters to note during interrogations, questioning, and the collection of documentary and physical evidence, and specifically highlighted prohibited behaviors that may trigger criminal legal risks and negative consequences.

In the section on determining corporate liability in corporate crimes, Attorney Nie introduced the characteristics of corporate crimes and specific scenarios where corporate crimes are established or not established. In determining corporate liability, Attorney Nie pointed out that the core elements for establishing corporate crimes are corporate intent, corporate behavior, and corporate interests, with the determination of corporate intent being the most complex and controversial. Relevant regulations classify the will of the entity into scenarios such as decisions made through collective deliberation by the entity, decisions made by specific authorized natural persons, tacit approval by authorized natural persons, and inference through objective behavior. In this regard, Attorney Nie emphasized that current legal regulations and judicial practices often recognize the will of specific authorized natural persons as the will of the entity. Therefore, she advised enterprises to prioritize institutional development, standardize the behavior of key personnel, and pay particular attention to specific fields such as environmental protection, as the law indeed imposes higher requirements on enterprise management. At the same time, Attorney Nie also presented her own differing views on the determination of corporate will, arguing that in the current context of increasingly完善 corporate governance structures, the will of specific natural persons should not be simply equated with corporate will. She proposed that the determination of corporate will should comprehensively consider the scale of the company; the larger the scale and the broader the range of interest groups involved, the more cautious the determination should be; the nature of the company should be considered, with distinctions made between companies controlled by individuals and those with complex equity structures; and the company's articles of association, management systems, and previous decision-making processes should be reviewed. If the alleged conduct did not follow established decision-making procedures, the determination of corporate will should be made with caution. These insights provide important guidance for companies to objectively assess their own responsibilities and protect their interests in individual cases.

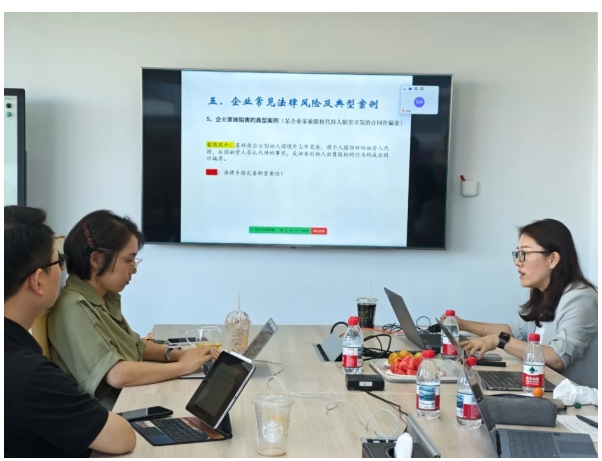

In the section on common legal risks and typical cases faced by companies, Attorney Nie Sufang drew on multiple real-life cases she had handled to focus on risks arising from imbalanced governance structures, financing risks, tax risks, food safety risks, commercial bribery risks, risks of false litigation, and risks of refusing to execute court orders. She provided in-depth analysis and explanations, and based on relevant cases, offered suggestions on criminal compliance awareness and compliance recommendations for companies.

Regarding the confiscation and disposal of involved assets, Attorney Nie Sufang explained that involved assets (involved property) include proceeds of crime and their derivatives, tools used to commit the crime (property used for criminal purposes), illegally held contraband, and other property that can prove whether the crime occurred and the severity of the crime (other property related to the crime and its derivatives).

Regarding the principles for the recovery of illicit gains, Article 64 of the Criminal Law stipulates two methods: recovery and ordering restitution. It specifically notes that property lawfully acquired by third parties is not subject to recovery. If a company has its property seized or frozen due to another party's criminal activities, it should promptly and proactively collect evidence demonstrating that the property was lawfully acquired to protect its legal rights and interests. Additionally, Attorney Nie addressed the issue of allocating recovery and restitution responsibilities in cases of joint criminal conduct.

At the end of the lecture, Attorney Nie Sufang offered the following suggestions for enterprises to prevent criminal legal risks, including shaping corporate culture, improving and effectively implementing corporate governance structures, leveraging the preventive role of directors, supervisors, and senior management, focusing on key prevention areas based on industry characteristics, and reviewing and preventing risks in financial operations.

After the two-hour training session, both online and offline participants actively engaged in discussions. Attorney Nie Sufang addressed questions raised by online participants, including the distinction and conversion between administrative and criminal liability in cases involving the issuance of fraudulent VAT invoices, how legal affairs can support business operations during tax audits, and the determination of shareholder liability in corporate crimes. She emphasized the special nature of tax-related cases and the importance of proactive compliance.

This training systematically outlined the key points for comprehensive prevention and control of criminal legal risks for enterprises. Drawing on her extensive practical experience, Attorney Nie Sufang provided New Hope Group and participants with recommendations that combine theoretical depth with practical applicability, helping enterprises build a robust “firewall” against criminal legal risks.