In a dispute between a company of a well-known Hong Kong group and a company of a Chinese head asset management group over the transfer of trust beneficiary rights, the Beijing Financial Court ruled in the first instance that the Hong Kong company should pay RMB 420 million as penalty for late payment, and that the company should face the legal responsibility of paying RMB 1.8 billion for the transfer of trust beneficiary rights. King&Capital Law Firm was entrusted by the twelve Hong Kong companies to file the appeal, and was led by senior partner Mr. Gong Piguo, who formed a special team with Mr. Gong Piguo, Mr. Wang Xiaoguang, Mr. Zhu Yuanxiao and Mr. Liu Feitong as the litigation agents, and with the participation of Mr. Li Mingzhen, Mr. Bai Xuelian, Mr. Zhang Lingqian, and Mr. Huang Ski as the trainees. After the team's full representation of the second trial stage, the Beijing Higher People's Court recently ruled to revoke the judgment of the first trial of the Beijing Financial Court, rejected all the other party's litigation requests, and the litigation costs of the two trials amounted to more than 4 million yuan to be borne by the other party.

01

Case Background:

Payment of 200 million yuan deposit gained nothing, the first instance judgment that the failure to pay the transfer constitutes a breach of contract

This case arose from a Hong Kong businessman's acquisition of a mainland non-performing asset business. A capital management company to the transferee of the enterprise debt to set up a trust, the size of more than 4.2 billion yuan, the trust project beneficiary rights split into priority beneficiary rights and secondary beneficiary rights, the secondary beneficiary rights transferred to our party, the transfer of the consideration for 2 billion yuan, the transferee a number of affiliates to provide performance guarantees. Prior to the signing of the agreement, the transferee had paid a deposit of RMB 200 million. After the signing of the agreement, the transferor failed to register the change in the transfer of the trust beneficiary right as agreed, and due to the epidemics and other reasons, the two parties signed deferred payment agreements twice. After the expiry of the deferment agreement, the transferor still failed to register the transfer, and the transferee did not pay the remaining $1.8 billion of the transfer, resulting in a dispute between the two parties.

The CMC petitioned the High Court of Hong Kong to wind up our Hong Kong company (bankruptcy) to pay off its debts, but later withdrew the petition. Subsequently, the Capital Management Company filed the present lawsuit with the Beijing Financial Court, claiming that the transferee should pay the default penalty for late payment and that the guarantors should be jointly and severally liable. The Beijing Financial Court, after hearing the case at first instance, held that the failure of our client, as the transferee, to pay the transfer amount constituted a breach of contract, and therefore ordered us to bear the liability for the overdue payment amounting to approximately RMB420 million, with each of the guarantors assuming joint and several liability. The result of the first instance judgment led to the extremely unfair result that the transferee had already paid 200 million yuan but did not get the trust beneficiary right, and also had to pay more than 400 million yuan of liquidated damages, and the companies had to face the risk of paying 1.8 billion yuan of huge debts.

As the chairman of a Hong Kong group, the acquirer, is a well-known person in Hong Kong and has certain influence in Hong Kong's business and political circles, the acquisition project and the result of the first instance judgment have aroused a high degree of concern in Hong Kong's political and business circles, and there have been continuous questions about the fairness of the mainland's judiciary and the business environment.

02

King&Capital Law Firm:

“Penetrating Review” of Trust Underlying Assets, Criminalization and Civil Preparation

Trusts and the trust business derived from them are highly specialized and special, and the vast majority of company operators are not familiar with them. As a professional organization, asset management companies often take advantage of their expertise to design more complex transaction models and agreement arrangements that benefit them. In this case, the trust beneficiary right transfer agreement and deferred payment agreement provided by the asset management company and signed by both parties were extremely unfavorable to the transferee. The court of first instance decided the case only on the basis of the apparent contractual agreement and our failure to pay, which seemed to have some justification on the surface. However, King&Capital Law Firm's team analyzed the facts and legal issues of the case and concluded that the trust in question, as a “channel business”, should not stop at the contract text, but should penetrate and examine the purpose of the trust and the authenticity of the legal relationship of the underlying assets, and seek a breakthrough in the level of the contract validity and the level of the contract performance.

The agency team searched comprehensively for information on the claims of the underlying assets of the trust, and found that the bankruptcy case of an enterprise group with substantive merger handled by Shanghai Third Intermediate Court involved the underlying claims. The bankruptcy ruling of the court clearly recognized that “the finance company, as the fund pool and transfer platform of the group enterprises, directly or indirectly through the finance company, carries out unified management and allocation of funds of the group companies, and the huge amount of receivables from the group companies recorded in its books lacked a real transaction relationship and did not have the feasibility of recovery”. The underlying asset claim is not feasible to be recovered. By accessing the files of the debtor companies of the underlying asset claims and analyzing the formation information of the underlying claims and debts, the agent team found that the claims involved in the underlying assets of the trust were actually claims of internal transfers or self-confirmation among the insolvent group companies. After repeated discussions and studies, the agency team established the agency opinion that “the claims on the underlying assets of the trust are false, the trust is invalid and the trust transfer agreement is invalid”. At the same time, the agency team designed a backing opinion that “if the contract is valid, the other party's failure to fulfill the prior obligation to register the transfer and our failure to make payment does not constitute a breach of contract”.

In addition, in response to the asset management company's concealment of the fact that “the company involved in the trust underlying asset claim was on the verge of bankruptcy and the relevant claim had no possibility of realization”, signing a false trust contract and trust beneficiary right transfer contract to transfer to us, and suspected of fraudulently obtaining 200 million yuan of deposit from us and continuing to demand 1.8 billion yuan of the transfer payment, the agency team, after thorough discussion, compiled a list of the suspected cases of the company and the person in charge of the company. After thorough discussion, the agency team organized the Criminal Complaint and 300 pages of evidence materials of the company and the person in charge suspected of contract fraud; for a trust company entrusted by the asset management company to set up the trust in this case, there were a number of violations of trust management regulations such as failure to carry out investigations, failure to trusteeship in accordance with the law, assisting the principal to set up the trust with false claims and other irregularities, and the agency team reported to the State General Administration of Financial Supervision. We designed a multi-dimensional and comprehensive litigation strategy with administrative prosecution and criminal indictment in conjunction with civil litigation, showing the practical experience of King&Capital Law Firm lawyers in handling complex and difficult cases.

Photos of work and some of the work documents (swipe left and right to view)

03

Expert argumentation:

Inviting experts in commercial law to testify, and the experts' opinions are of a high level

In view of the complexity of the case, the trust law, company law and other commercial law issues are relatively esoteric, in order to demonstrate the feasibility of the litigation program and improve the quality of the case, the team relied on the academic resources of the King&Capital Law Firm to invite five authoritative experts in the field of company law, trust law, and the University of Political Science and Law, Peking University School of Law, Tsinghua University School of Law to hold an expert argumentation meeting. The experts included the head of the Commercial Law Research Society of the China Law Society, and members of the expert group for drafting China's Civil Code, new Company Law, Trust Law and other laws. The experts discussed the facts and legal disputes of the case in depth, and guided the agent team to pay attention to the practical operation of the case, and finally formed a theoretical and practical combination of Expert Opinion, which was submitted by the agent to the court for the panel's reference.

04

The second trial to change the judgment:

The court “talked” six times to investigate the disputed facts, and the Beijing Higher People's Court reversed the original judgment in the second instance.

The case was complex and specialized, involving disputes over the rights and interests of Chinese central enterprises and Hong Kong enterprises. The panel of the Beijing High Court successively organized six “conversations” between the agents of the two parties, conducted in-depth and detailed investigations into the establishment and registration of the trust in question, the background of the transfer agreement, the status of the agreement's implementation, and the disposition of the trust's rights and interests after termination of the trust, etc., and organized the two parties to present evidence, challenge the evidence, and debate in the court, so as to lay a foundation for a trial and a fair judgment. Factual basis for the trial and fair judgment.

In the course of “conversation” and court hearing, King&Capital Law Firm submitted a large amount of evidence on the claims of the underlying assets of the trust, and made use of the evidence submitted by the other party to clearly emphasize that: the claims of the underlying assets of the trust involved in the case were the internal business transactions of the Group, which had been ruled by the court to be “not authentic”, and the underlying assets were false and “not real”. If the underlying assets are false, the trust is invalid according to the law and the trust beneficiary right transfer agreement is invalid. To take a step back, even if we do not consider the issue of contractual validity, the transferor did not perform the prior obligation of transferring the trust beneficiary right according to the agreement, and we did not obtain the trust beneficiary right and did not pay the transfer payment, which was the exercise of the defense of prior performance and did not constitute a breach of contract. The agency team finally emphasized that the transferee in this case paid 200 million yuan without any income, and the court of first instance ordered it to pay another 400 million yuan in liquidated damages, and the transferor only produced a set of trust documents but had to obtain more than 600 million yuan in income, this kind of judgement that is against the common sense and extremely unfair should be withdrawn, or else it will become a negative jurisprudence affecting the business environment and legal justice in mainland China!

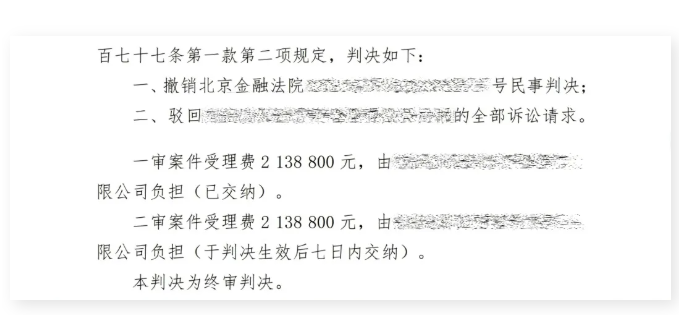

The Beijing High Court recently issued its judgment after more than six months of discussion and research. Although the second instance judgment did not reject the validity of the contract, but comprehensively adopt the views and evidence of King&Capital Law Firm's team of agents about the other party's breach of contract, and concluded that our non-payment of the transfer payment is the exercise of the right of first performance defense does not constitute a breach of contract, no need to bear the liability for breach of contract, to revoke the judgment of the first instance, and to reject the other party's full claims. The result of this judgment corrected the error of the first instance judgment that we should pay RMB 420 million as liquidated damages, and also clarified the judgment that “the other party's failure to fulfill the obligation of transferring the beneficiary rights of the trust, and our non-payment of RMB 1.8 billion in transferring the money, did not constitute a breach of contract”.

05

Conclusion:

Cover the volume of deep thought, a lot of feelings, organize three points, and share with readers

First, professionalism and responsibility is the lawyers to win the lawsuit.

Trust and its derivatives of trust products, has a strong professionalism and complexity, based on the management company's professional advantages, once the dispute, the counterparty is basically in a disadvantageous position, the lawyer on behalf of the counterparty, the practical disposal of the greater difficulty. To “penetrating trial thinking” research case, in the investigation of the trust base asset claim is enterprise group internal enterprise current account and is recognized as “lack of real transaction relationship” based on the effective legal documents, the lawyer team proposed "Based on the investigation of the trust underlying assets are false, the trust is invalid, the trust beneficiary right transfer agreement is invalid, although the court of second instance based on a number of factors did not adopt, but the research methodology and argumentation of this issue, show King&Capital Law Firm lawyers through the surface phenomenon of the underlying logic of the transaction of the professional thinking; administrative prosecution, criminal indictment, civil appeals, and comprehensive litigation strategy. Compatible with the comprehensive litigation thinking strategy, as well as the team to discuss the repeated debates on the handling of the case, demonstrated the King&Capital Law Firm lawyers on the difficult and complex cases of comprehensive control and practical experience; and the court required each appellant to pay a total of nearly 30 million yuan of appeal fees, the agency team reasoned to repeatedly communicate with the payment of an appeal fee of more than 2 million yuan for the parties to save tens of millions of appeal cost of a small victory, but also in the Practice details reflect the King&Capital Law Firm lawyers “not to be entrusted” practice philosophy.

Second, the professional fraud, legal cheating money trust chaos should be curbed.

Trust, originally is the value of special, legitimate mature financial tools, but in recent years, the financial field, “master” but to trust as a tool to design a complex and confusing channel business, transfer the risk of fraud and even fraud and crime to obtain unlawful interests. “The existence of the channel is to turn non-compliant things into compliant things”, which is a joke in the trust circle, but in this case, the transaction and the first instance judgment prophetic: worthless claims to set up a trust, but in exchange for the transfer of 2 billion yuan of consideration; the acquirer has paid 200 million yuan of nothing to get, the court ruled to pay more than 400 million yuan of liquidated damages The transferor made a set of trust documents, but to income of more than 600 million! The second trial of this case to change the judgment, to stop the other side to us to continue to ask for unlawful benefits of the wrong behavior, for the use of trust tools to make illegal profits of the financial chaos, will play a certain role in judicial warning.

Third, the revision of the judgment in this case corrected the wrongful judgment of the first instance and protected the legitimate interests of Hong Kong enterprises and entrepreneurs.

The actual controller of the acquirer in this case is a well-known patriotic entrepreneur in Hong Kong and a Justice of the Peace in Hong Kong, who has made outstanding contributions to the unification cause of Hong Kong's return to the mainland and the exchanges and development between the mainland and Hong Kong. The reversal of the judgment of the second instance of this case reflects the fairness and justice of China's judiciary, demonstrates the Central Government's policy of treating Hong Kong enterprises fairly and protecting their interests in accordance with the law, and serves as a typical case of optimizing the business environment to promote the development of cooperation between the Mainland and Hong Kong.